Carrie Sheffield

Contributor

Opiniontime - 11/17/2014

Forbes

Stockton Highlights Nationwide Risk Of Conflict Between Muni Investors And Public Sector Unions

Fixed-income investors are now on notice that their rights could be trumped

by public-sector union bosses, following a

court ruling granting Franklin Templeton Investments just pennies on the

dollar for its muni bonds from bankrupt Stockton, California. And the case is

only one of many across the country. (Therefs no word yet on whether Templeton

will appeal.)

The ruling, while distressing, should not be surprising. In part, because

investors are subject to an unfair information asymmetry at the hands of state

and local governments. Itfs well-documented

that government pensions tend to understate their pension and other obligations

to workers and retirees, potentially hiding some risk

from bondholders.

Yet, itfs not all bad news for investors. While this most recent ruling

clearly favored public employees over investors, in an earlier

ruling the same judge made history in the Golden State by designating

pensions as impairable—subject to a haircut in the event of bankruptcy. Pensions

may still get favorable treatment, but no longer in automatic fashion.

Stockton is not alone. A new report from Moodyfs Investors Service shows just

how widespread the risk runs as investors weigh whether to put their trust in

municipal officials. The question is whether Stockton could be a wake-up call

for city managers and union leaders across the country to tighten their belts

and lower the temperature at the negotiating

table.

gWhen municipal credit deteriorates to the point of service insolvency and

results in bankruptcy or receivership, bondholders can find themselves in fierce

competition with pensioners and current employees over resources and priority of

payment,h wrote my former colleague Al Medioli, vice president and senior credit

officer at Moodyfs.

In my former life as municipal bond analyst with Moodyfs (I rated hospitals

that behave like businesses in many ways but receive the tax benefits of a

not-for-profit and thus fall under the muni umbrella), one of the factors we

considered was whether a debt-issuing entity was unionized, a status that was

inherently viewed as a gcredit negativeh due to unionsf ability to disrupt

operations. When we observed a history of obstreperous union leadership, we

noted this to investors.

gDespite this decision to confirm Stocktonfs plan leaving pensions intact,

local governments will now have more negotiating leverage with labor unions, who

cannot count on pensions as ironclad obligations, even in bankruptcy,h Moodyfs

wrote in another report after the ruling.

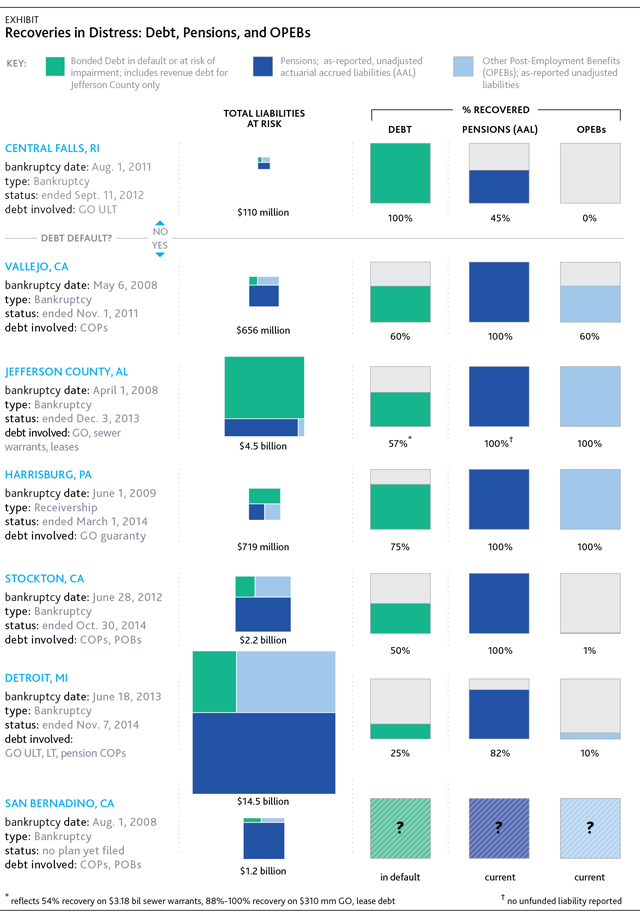

This will also help cities better with Other Post-Employment Benefits

(OPEBs), which typically include life insurance, health care benefits, and

deferred-compensation. In the Stockton bankruptcy, only 1 percent of OPEBs were

recovered. During restructurings, OPEBs are often used as a bargaining chip to

cash in favor of pension protections. And as with pension obligations;

oftentimes the OPEB obligations are obscured. The sheer irregularity of such an

arrangement and the politicization of these benefits will no doubt be red flags

to potential bondholders as they choose where to invest in the future.

Mediolifs report examined the seven substantial municipal restructurings

that have occurred since 2008. Of the seven, just one (Central Falls, Rhode

Island, where bonded debt made up a small fraction of liabilities) took a

haircut on pensions while making investors whole. The other five (San Bernadino,

California, is still pending) favored pensions: four paid 100 percent to their

pension funds while skimming from investors. Detroit was ordered to pay 82

percent for pensioners and only 25 percent to investors.

Such thumb-on-the-scale restructurings in favor of union leaders creates

economic moral hazard: City stewards are less likely to enact urgently needed

pension reforms if they know accountability is unlikely. Workers and retirees

put their hard-earned money into pension systems and are understandably anxious

to enjoy the fruit of their labors. Yet cities that make unsustainable defined

benefit promises do a disservice to their workers. Some muni bond issuers have

shifted

to a hybrid model with features of a 401(k)-type defined contribution

structure with some guaranteed contributions. This is more sustainable for both

taxpayers and workers.

gReality is not negotiable,h former Utah state Sen. Dan Liljenquist, a

Republican who helped push a hybrid model in his state, told The Wall

Street Journal. gThe fact is somebody bears the risk. Ultimately, the

state is bearing more risk than it can.h